The lower cost of a reducing policy could leave space in your budget to include some critical illness insurance. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

Mrta Mlta Which Is Your Preference Propsocial

For example if you know after detailed.

. Premium could be paid Monthly Quarterly Semi-Annual and Annually. 5 rows The housing loan protection plan for public servants. It depends on how severe the illness is and will only be determined after a medical examination by their panel doctors.

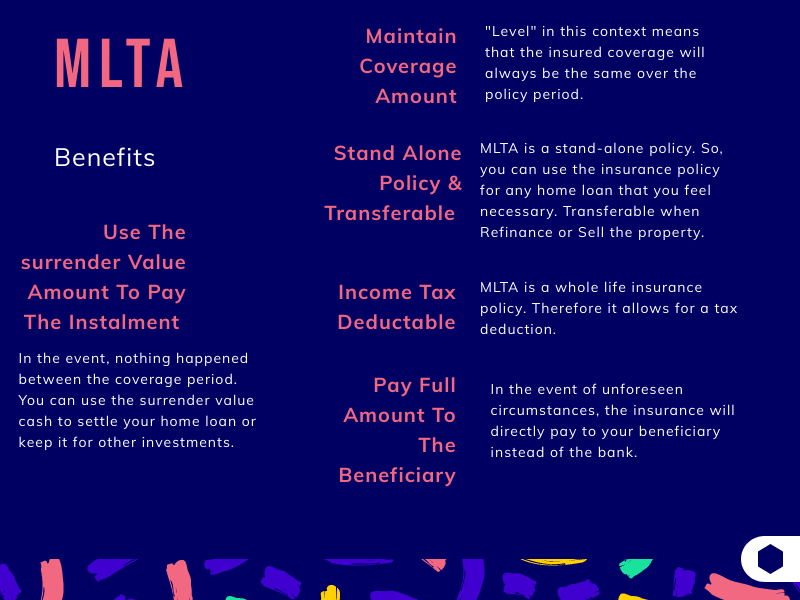

And if youre one the tens of thousands of first-time home buyers out there who are wondering why you need to fork out. In the case of an MRTA the sum assured can be set at an amount up to the mortgage loan amount at the time the policy is purchased. High Health and Protection coverage High insurance coverage for Death or Terminal Illness High insurance coverage for Early Critical Illness Critical Illness or Total Permanent Disability Lower.

As you pay off your home loan the value of your outstanding debt will fall. Mortgage Reducing Term Assurance MRTA If youre taking a home loan to buy a property chances are. If you need a loan in order to buy a house you approach a bank but while running you through their due process they suddenly mention MRTA Mortgage Reducing Term Assurance and encourage you to buy it.

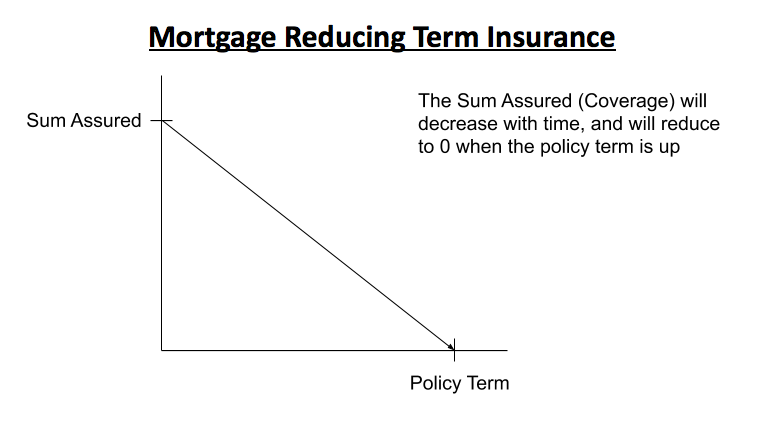

However today you have more flexibility on choosing your property asset risk planning. This means that as you pay down your loan the remaining coverage drops as well. Mortgage Reducing Term Assurance MRTA A comprehensive term life assurance that provides financial protection in the event of premature death or total permanent disability.

Youll be required to pay for Mortgage Reducing Term Assurance or MRTA by the bank as part of your loan arrangement. Effective upon legal home ownership. Mortgage Protection Pays off your outstanding mortgage with a reduced sum assured in the event of your death total and permanent disability TPD prior to age 65 or upon diagnosis of terminal illness during the term of the coverage.

For example if you have a 500000 mortgage with 500000 MRTA and you pay off 80000 of your mortgage your remaining coverage will now be 420000. Well Help You Get Started Today. Mortgage Reducing Term Assurance MRTA is a type of home loan insurance where the sum insured is designed to reduce over the term of your home loan.

Ad The Leading Online Publisher of National and State-specific Real Estate Legal Documents. AIA Mortgage Reducing Term Assurance may potentially be a good fit if the following matters to you. The rate at which it reduces usually depends on the mortgage interest rate that is determined at the onset of the policy.

No limit subjects to underwriting should Sum Assured exceeds RM550000. Mortgage Reducing Term Assurance MRTA is insurance that covers the borrower in the event of death or total permanent disability TPD. Premium can be paid by CPF OA.

MRTAs minimum tenure is five years but it is your prerogative on how many years you want to buy. Mortgage Reducing Term Assurance MRTA Method of payment. 40 years inclusive of deferment period or expiry at age 70 years old whichever is lower Deferment Period.

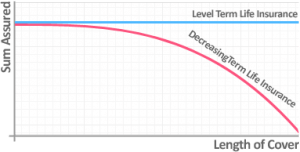

Mortgage insurance or Mortgage Reducing Term Assurance MRTA protects your family from paying the outstanding mortgage on your home if you were to die or become permanently disabled. The initial Sum Assured of Mortgage Reducing Term Assurance MRTA reduces on a monthly basis from the first policy year. Unlike term life insurance where the sum assured remains the same across the policy term the sum assured on your mortgage insurance will decrease over time.

Mortgage Reducing Term Assurance MRTA Your home is one of your most important assets. Under Mortgage Reducing Term Assurance MRTA the insurance company will cover the outstanding loan. Decreasing Term or Mortgage Reducing Term Assurance MRTA is a type of mortgage insurance that drops over time.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Calculate Compare Mortgage Options Then Contact Our Experienced Agents. MRTA offers affordable premiums with your coverage tied to the outstanding mortgage that you have.

In Singapore mortgage insurance is also known as a Mortgage Reduced Term Assurance MRTA as the sum assured is gradually reduced as the housing loan gets paid off every month. This means that as you repay and reduce your outstanding mortgage your sum assured will also. Ad Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You.

MRTA gives you protection which reduces over time until it reaches zero. Century 21s Mortgage Calculator Helps Calculate Your Estimated Monthly Mortgage Payments. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Approximately RM3500 for every RM100000 protection. If you have no other financial concerns beyond your mortgage it may be best to stick to the reducing term life. 9 rows Mortgage Reducing Term Assurance MRTA provides coverage for the outstanding home loan amount.

In the event of the insureds death this plan will help you repay the balance of your mortgage your family will not need to worry about the burden of mortgage payment or loss of the house. Premiums can only be paid by cash. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

However MRTAs are decreasing term policies which means the sum assured reduces yearly. Mortgage Reducing Term Plan II underwritten by BOC Group Life Assurance Company Limited BOC Life provides you secure mortgage protection. For private property and executive condominium owners it is not compulsory to take up mortgage insurance.

However there are instances where the reducing option is beneficial. Ad Were Americas 1 Online Lender. Mortgage Reducing Term Assurance MRTA Protection.

When unforeseen circumstances happen per se the death or TPD. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. MRTA also known as Mortgage Reducing Term Assurance is an insurance for your housing loan.

But it is essential to save your family from any trouble in future in. Buying a house is not easy especially with the. See Todays Rate Get The Best Rate In A 90 Day Period.

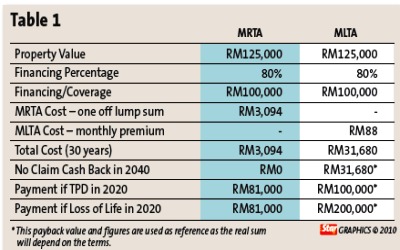

MRTA was compulsory in the past. Heres how much you need to pay in premiums for MRTA compared to MLTA based on insurance cover for a mortgage loan amount of RM540000 at 4 interest over 30 years for a 25-year-old homeowner. MRTA ensures that if something happens to you your mortgage loan is repaid and your home is.

Effective upon approval of home loan. This protects home owners in the event of death or TPD.

Mrta Vs Mlta And How Much Coverage Is Needed Mypf My

Property Educational Articles Mpig

Decreasing Term Life Insurance Life Insurance Glossary Definition Sproutt

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

保险资讯网 Insurance Info Net 房贷险是指贷款人如果因意外伤害事故死亡或伤残 丧失全部或部分还贷能力后 可由保险公司替其向银行还贷的责任保险 Mortgage Reducing Term Assurance Mrta 1 定期保单 保额将会定期性减少 2 死亡及终生全残保障

Mrta Vs Mlta Difference Comparison Table Easy To Understand

What Is Mortgage Reducing Term Assurance Mrta

Understanding Mortgage Insurance Hps Vs Mrta Vs Term Life

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mrta Mlta Which Is Your Preference Propsocial

Mortgage Or Loan Term Insurance The Star

Mortgage Insurance In Singapore Ultimate Guide For 2022

Mrta Vs Mlta Difference Comparison Table Easy To Understand

What Is Term Life Insurance 2022

5 Features That Differentiate An Mrta From An Mlta Property Talk Malaysia

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mrta Or Mlta What Are The Fallacies

How Does Decreasing Term Life Insurance Work Guide Drewberry